Supported foreign exchange option product structures:

European, American, Asian options, exotic options (Barrier, Touch)

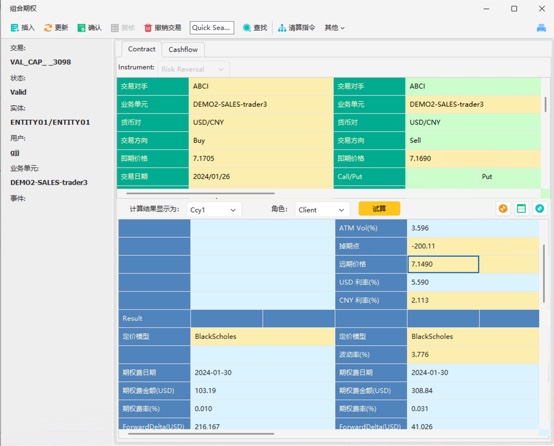

Simple option strategy; Risk reversal, spread options, straddle, strangle, butterfly combinations, etc.

Structured forward combinations; Par forward, range forward, ratio forward, downside forward, upside forward, dual currency forward, seagull combination forward, target forward, etc.

Pricing of structured products for foreign exchange and interest rates (2-layer, 3-layer structures, snowball structures, etc.), customizable product structures through scripting

Pricing tools, providing pricing tools for the above-mentioned products for pricing, calculating Greeks, reverse calculations, etc.; volatility surface, forward curve, etc., pricing results can be exported in CFETS trading format

Supports batch pricing, batch valuation of trades

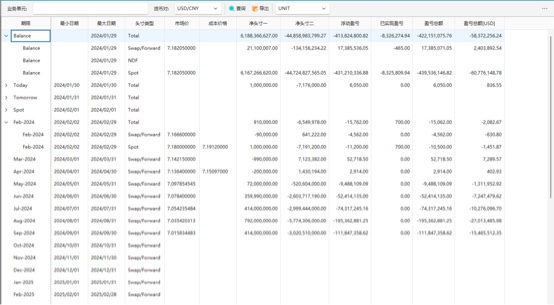

Trade bookkeeping and management for the above-mentioned products

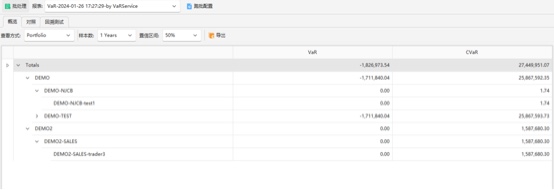

Trade valuation, valuation reports for the above-mentioned products

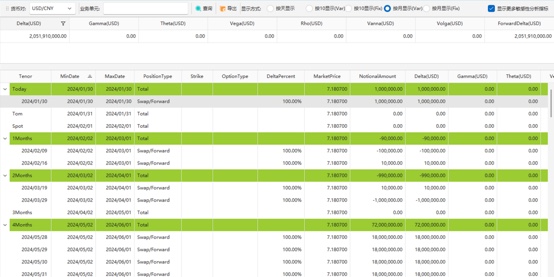

Monitoring of delta, vega, and other exposures

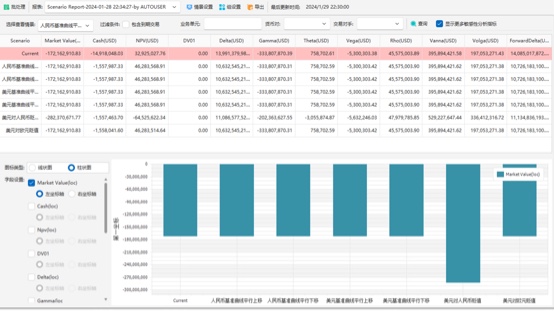

Sensitivity analysis, scenario analysis, stress testing

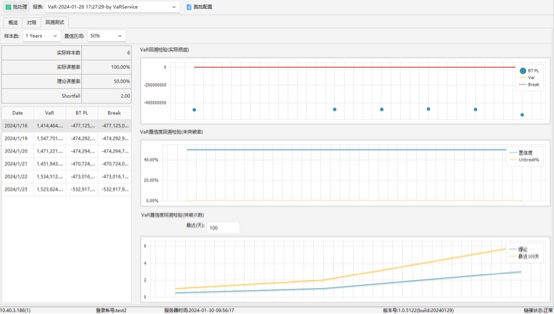

Option strategy backtesting, backtesting analysis of option strategies based on historical data

Market data can be integrated with Bloomberg Terminal, Reuters EIKON Terminal

Provides Excel templates and supports system API interfaces

We provide free online pricing tools for financial practitioners, supporting the pricing and valuation of some of the above-mentioned options

For more information, please download Meridian Mammoth Valuation Pricing Library - Forex Option Pricing Engine White Paper. pdf

Click to use Mathema Options Pricing System for Free

https://fxo.mathema.com.cn Login and use via SMS on mobile phones

021-50805159

market@meridian.com.cn

WeChat customer service

Simple options (European, American, Asian), exotic options (Barrier, Digital), structured forward (option combinations, combinations of simple options and exotic options)

Supports valuation (calculating premium) and pricing (reverse calculation of strike, etc.)

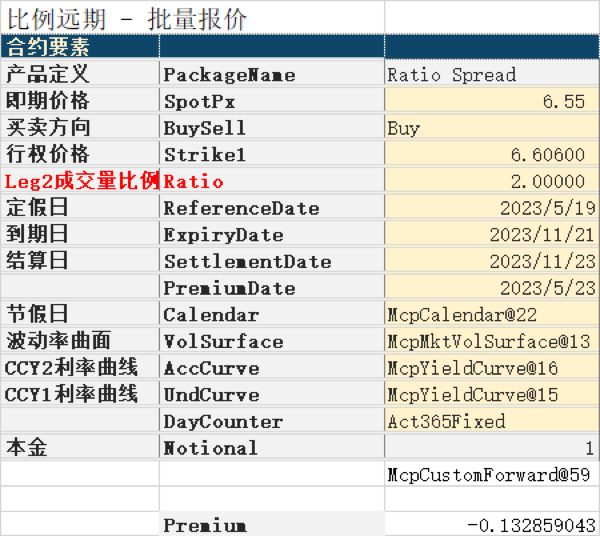

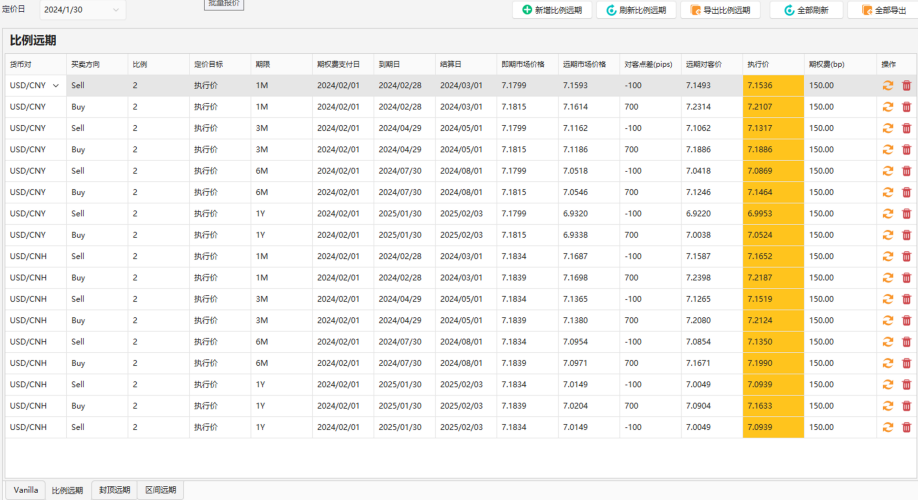

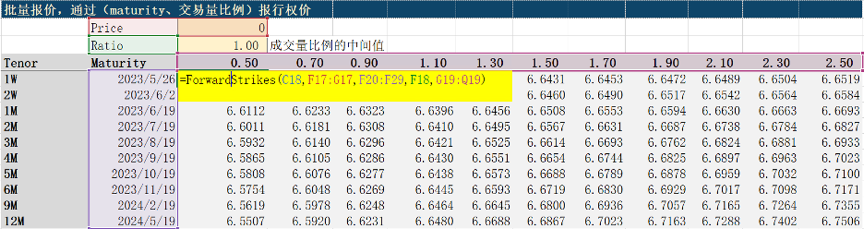

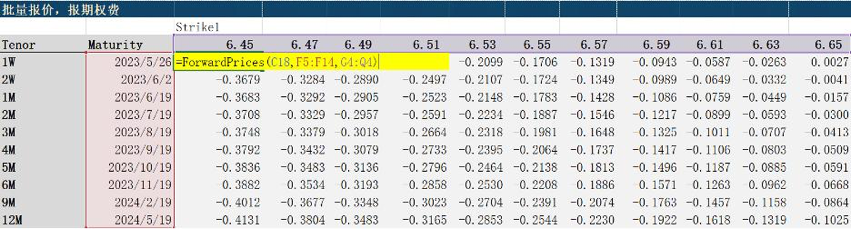

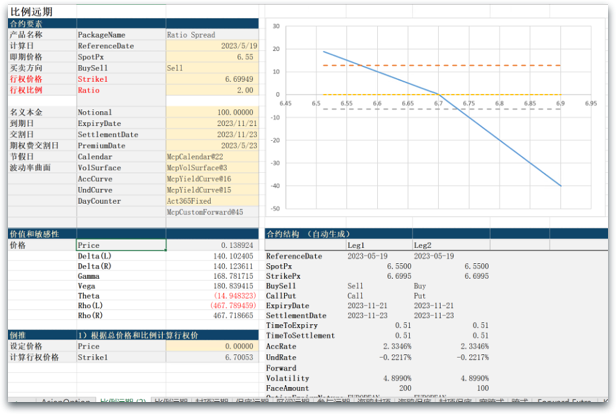

By setting calculation parameters, batch pricing is performed on options with different maturity dates and exercise prices, using proportional forward as an example:

(Excel version)

(Client version)

Set the basic parameters for long-term proportion setting

Lock in the option premium and report the exercise price in bulk based on the maturity date and trading volume ratio

Batch reporting of option fees through expiration date and exercise price

Historical data of options market

The system stores 10 years of historical data, including historical exchange rate prices, volatility, and returns. These data can be used to backtest option trading strategies, view different backtesting indicators such as profit and loss, annualized returns, Sharpe's ratio, and maximum backtesting, and display changes in historical value and risk indicators. Provide data support for your trading strategy

Transaction backtesting

Backtesting option strategies to examine changes in value and risk

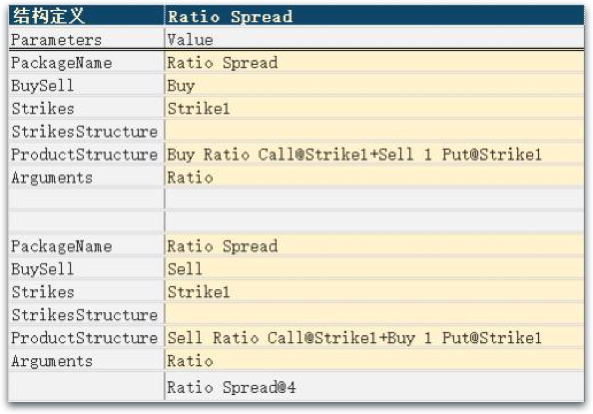

The system supports product definition and constructs new portfolio products by setting the combination method of underlying assets.

For example, through (BUY 1) call@k1 +Sell 2 call@k2 )To define the structured products of RATIO SPREAD and generate contracts, so that account managers only need to be familiar with the elements of the RATIO SPREAD contract and PAYOFF, without the need for details of the option structure.

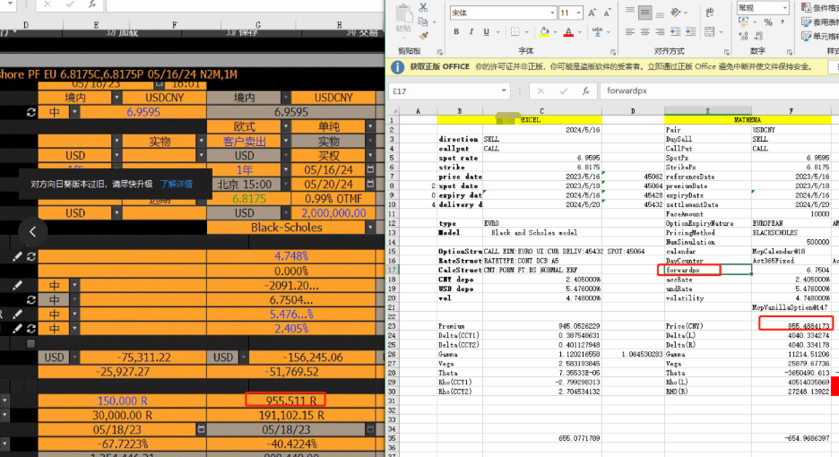

During the pricing process, different pricing tools may use inconsistent calculation parameters, which may result in inconsistent calculation results. We can adjust the calculation parameters (usually DayCounter, Basis, etc.) based on the correction target you provide to achieve a result that is basically consistent with the correction target. Taking Bloomberg Terminal (OVML) as an example:

By adjusting the DayCounter for discounting and interest calculation, it is possible to achieve basic consistency with Bloomberg's system results:

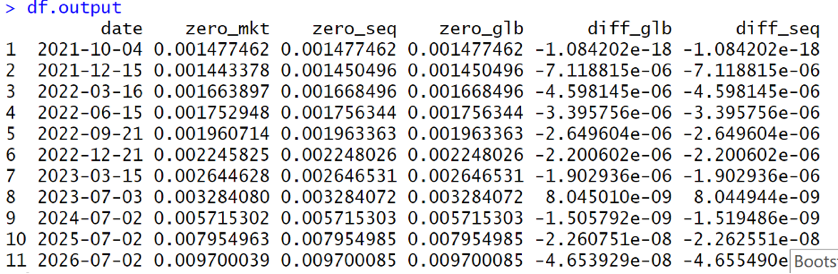

zero_mkt: Zero interest rate calculated by Bloomberg system

zero_seq:The curve zero interest rate result optimized by (Sequential)

zero_glb:The curve zero interest rate result optimized by (Global)

diff_glb、diff_seq:Difference

By setting the DayCounter and interest rate parity calculation method, the difference between the pricing results of Bloomberg OVML can be achieved (1.15E-08).

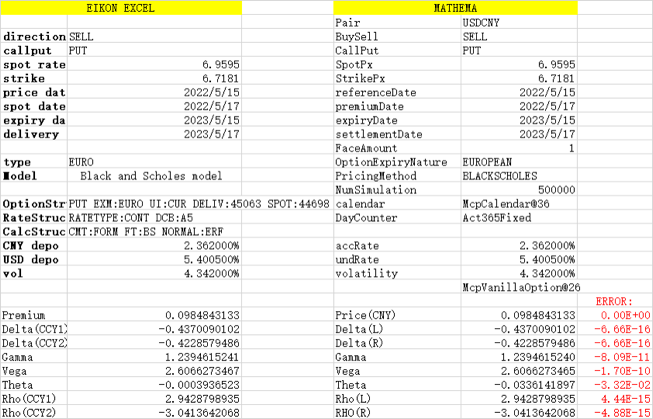

By setting parameters, it is possible to achieve complete consistency with the pricing results of Reuters EIKON Excel

Note: If parameters are not set or corrected, the default calculation parameters given by different calculation tools will be different, and the results will also be different.

Actual test results, taking the snowball structure (a structured derivative with periodic observation and knock in and knock out conditions) as an example

2 million Monte Carlo simulations, 252 paths:

| GPU | 1,377 μs | |

| CPU(20 threads) | 376,412μs | GPU acceleration 273x |

| CPU(Single threaded) | 4,402,630μs | GPU acceleration 3197x |

Foreign exchange market and interest rate market derivatives, as well as market risk management

Provide foreign exchange structured forward pricing and valuation tools for pricing and valuing derivative products provided by banks, and produce market risk reports

Provide bulk quotations for structured forward (including proportion, range, cap, etc.) varieties of foreign exchange agents